Summary Introduction

In this commercial transaction, our investor client secured a high-yield medical asset in Castle Hill—off-market, fully tenanted, and with future development potential. All due diligence was managed end-to-end by our team.

The Brief

Our client—a time-poor professional—wanted a tenanted commercial property with:

• Strong rental yield

• Medical or national tenant

• Future capital growth or development potential

The search area included the Hills District, South Sydney, and Northern Beaches.

Our Approach

We:

• Sourced on- and off-market assets in target areas

• Built a shortlist focused on zoning, lease strength, and tenant quality

• Discovered an off-market Castle Hill property aligned with all criteria

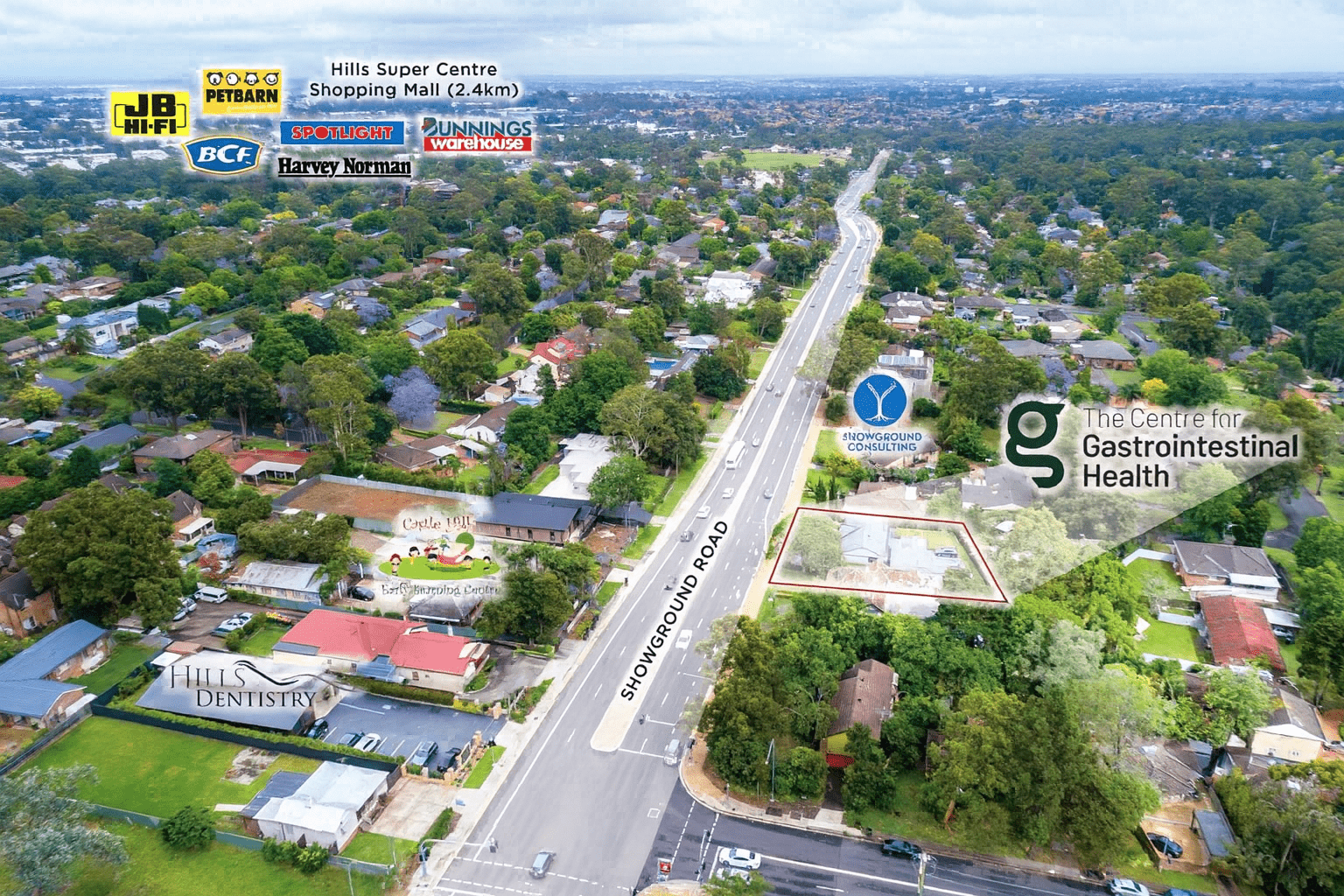

The Property

Freehold on over 1,000sqm of land

- • Zoned R2 with future development potential

• Leased to a medical tenant until 2030 with 10-year option

• Fixed annual increases built into lease terms

• Located near Castle Towers and the new Hills Metro

The Result

Exclusive access secured via agent relationship

- Thorough due diligence conducted remotely

- No buyer competition

- Long-term rental stability with upside through zoning

- Stress-free purchase experience for the client