As 2025 comes to a close, it’s a great time to reflect on the year that’s been and what lies ahead for the Sydney property market.

It’s been a whirlwind year for us. We’ve helped more than 40 clients so far with their property goals, and we’re incredibly grateful that 90 percent of our clients have been introduced through word of mouth.

The Sydney property market in 2025 has seen significant change. We had three interest rate cuts, a ban on non-Australian citizens purchasing established dwellings, zoning reforms to increase density across key suburbs, and the launch of a five percent deposit scheme aimed at first home buyers.

Overall, property prices have risen 5.6 percent since the start of the year, but results have been mixed. At times, demand was strong for the right property. More recently, we’ve seen some great buying opportunities across a range of price points and regions.

Conditions have become more segmented, with clear differences in demand depending on the location and type of property.

This highlights the value of working with a buyers agent. Our role is to understand the different sub-markets, read the shifting dynamics, and help our clients move strategically when the right property presents itself.

4x Highlight Successes

Castle Hill, Moss Vale, Darlinghurst, Northbridge

Castle Hill

Moss Vale

Darlinghurst

Northbridge

This year, we’ve observed three clear trends emerging among our clients:

A preference for turnkey homes or properties that only require cosmetic updates. This shift is driven by the unpredictability of building timeframes, planning restrictions, and rising construction costs. There’s also the emotional toll — many are choosing to avoid the stress that major renovations can place on relationships.

Clients are more willing to stretch to the top of their budget for the right property. This comes down to a few key factors: the need to purchase within a set timeframe, the increasing value placed on personal time, the volatility of other asset classes, and a greater desire to invest more of their net worth into their principal place of residence.

Longer settlements of 90 days or more are becoming the norm. With the logistics involved in moving, both buyers and sellers are preferring more time to plan and transition without unnecessary pressure.

In previous years, we saw more appetite for value-add opportunities and faster settlements. But right now, lifestyle factors, time constraints, and financial certainty are playing a much larger role in how people approach the market.

Our 4th End of Year Event

What Can Be Expected in 2026

We’re expecting interest rates to rise in 2026 as the RBA focuses on restoring stability in the economy. Buyer depth is likely to increase in the first quarter, and while quality homes will remain in demand, overall market conditions are expected to be more subdued heading into the cooler months.

With a range of policy and market changes rolled out in 2025, next year will be a period of adjustment for many buyers and sellers. We anticipate:

Lower stock levels, continuing the supply-demand imbalance. Increased migration, adding pressure to housing demand. Investor activity returning, particularly in growth corridors

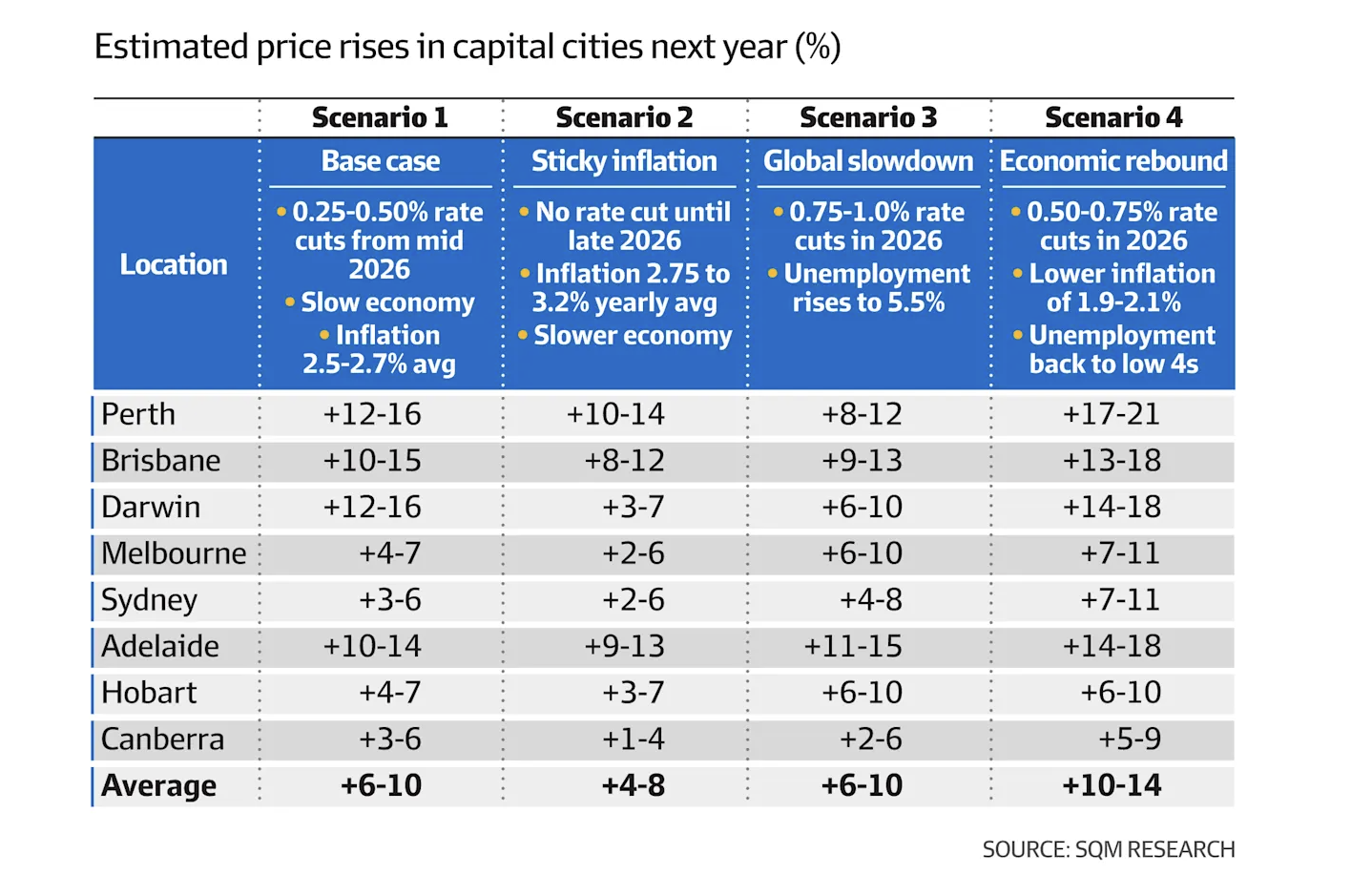

SQM Research has also released its annual Boom or Bust Report, outlining growth scenarios across the capital cities for 2026 (See below).

If you want to have a chat about the current market or your property plans get in contact with us today.