Properties that have flaws or work required with construction costs have gone up over 30%

Through my extensive understanding of market trends, buyers/clients are taking exception to properties that have flaws or work required with construction costs having gone up over 30% this year alone. However, if it’s a property that requires little to no work in a sought-after area these properties still have great competition and are selling well. A good example of this was an auction I was bidding on for a client in Northbridge, the asking price was $5.25m – $5.75m and I advised the client to pay up to $5.5m. The property ended up selling for just over $6m at an auction with most of the street in attendance.

Another factor that plays into the buyer/seller motivations is expectations of both sides with owners seemingly oblivious in many cases to current market conditions & buyers thinking 2-3 months in advance. This has caused a divide between what a property is worth and is a big cause of the confusion with price guides being dropped quite regularly in most cases I put it down to expectations of owners. My advice to clients currently the majority of the time is let’s wait and let the property campaign play out or keep that off-market property on the monitor list, if someone comes in loves the property and we miss out so be it. It’s more important to buy the property for the lowest price and in large part this is being driven by owners being more realistic.

Prestige sector and low stock: the buyer pool outweighs owners willing to sell which is keeping prices strong.

For the prestige sector, what I am seeing is a low stock which means that the buyer pool outweighs owners willing to sell which is keeping prices strong. There is also the case of properties sitting on the market for much longer than usual as owners are unwilling to budge and buyers standing their ground. This is a general statement, but this market is less rate sensitive and is more supply/demand driven. As ex-pats continue to return home this market just seems to be moving from strength to strength.

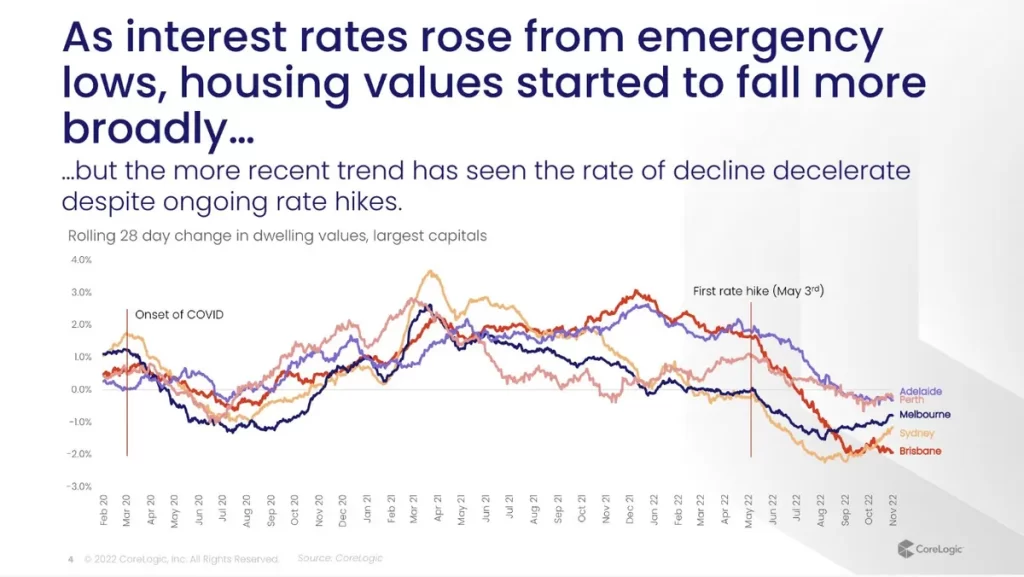

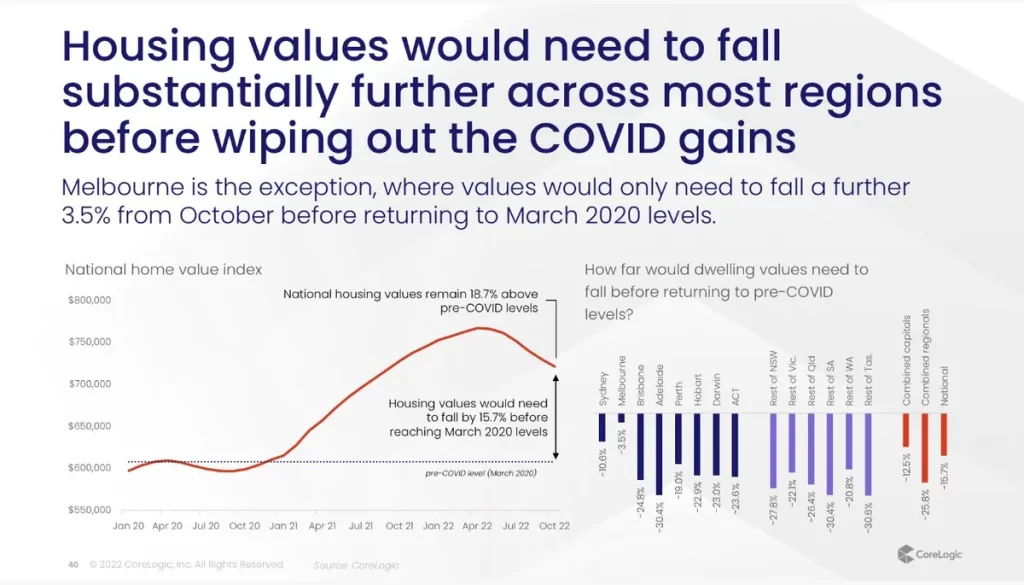

Attached is a great article by Chief Economist Dr Shane Oliver who lays the foundation for why Australia should be able to sit at around 1.5% economic growth in the next year. I have also included some interesting charts from the Head of Research at CoreLogic, Tim Lawless. Interest rate correlation to declining housing values chart has a valuable finding which is that the largest property declines month by month were seen around May as the first-rate hike occurred. Since then, the rate of decline has decelerated despite ongoing rate hikes. This could be down to buyers becoming more comfortable with their predicament. Price declines needed to reset gains of recent years chart highlights the percentage decrease in house values still needed to erase all the gains that were made in the last two years.

In Depth Market Update

I felt it would provide value to put together a more detailed property market update as we head into Christmas. The mass media is causing plenty of confusion among property buyers & sellers alike with what’s happening on the ground. In particular, the articles that mention large price declines or the most affected areas. In this email, I have attempted to dissect the parts that are relevant to the vast majority of us in Sydney.