With only a few weeks before we head into the Easter break it’s a good time to look back on the first 3 months of the year and what’s to come in the Sydney property market. Since our last update in November we have seen the market stabilise into being a buyers market. Clearance rates this week were 48.1% according to SQM Research highlighting the shift.

We have had an action packed first quarter with the first full rate cut in 4 years bringing renewed positivity into the market, an impending election on May 3rd which is causing some uncertainty, new increased density regulations across Sydney which are very much in a stage of let’s wait and see and a 2 year ban on all foreign purchases being implemented.

This influx of change is certainly bringing some patchy results across the marketplace. We are seeing that turnkey homes/apartments & rare knockdown/renovation opportunities that offer larger block size or impressive views selling strongly. However properties that are needing minor renovations, have basic features or are lacking in size/location are generating less interest.

The depth of the buyer pool is the biggest shift, numbers at open homes are higher than normal but there are on average only 1.5 real buyers for each property. This is highlighted by the low clearance rates with the majority of properties selling off market or prior to auction.

4x Recent Purchases

Northbridge

Seaforth

Marrickville

Zetland

Low to Mid Rise Housing Policy Changes to Unlock More Housing

From 28th February, there were wide scale changes to the low/mid rise housing regulations across hotspots in Sydney. If you live within 400m or 800m of a town centre and are located in either R2 or R3 zones there will now be an ability to build up to either 3x levels or 6x levels in height with an increase in floorspace ratio.

I don’t expect this to have an immediate affect on the market. After catching up with a developer client last week, he mentioned that they have been inundated by these new development opportunities. The only caveat is a nearly 40% divide in the price the owners are seeking and the price that developers can pay to make the site viable.

If you’d like to view the LMR Interactive Map to see if you’re in located in one of these hotspots click on the link: https://rb.gy/gs02t1

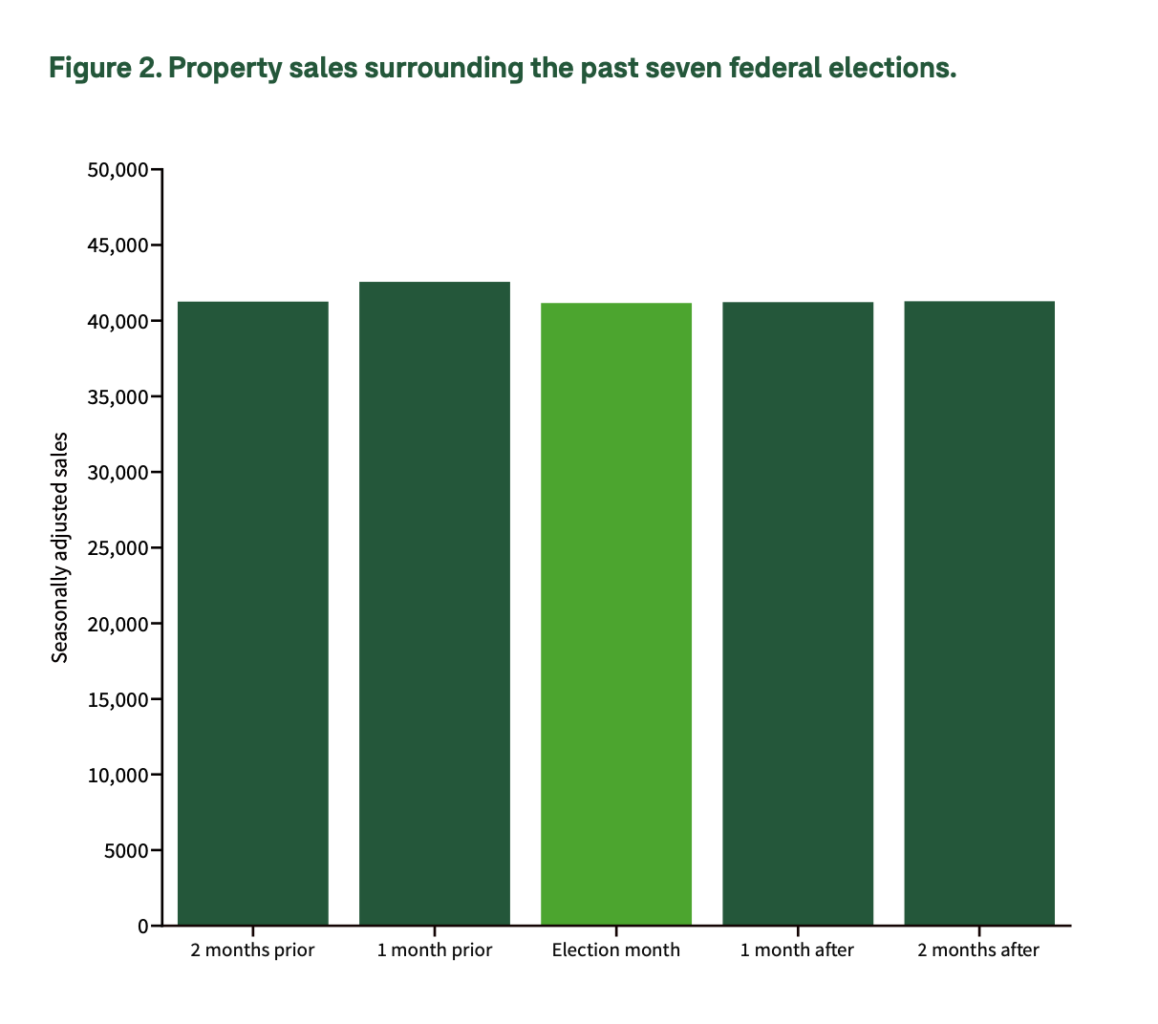

With the election upcoming on May 3rd, it tends to put a slight pause on property decisions. But as you can see above in the graphic (provided by Domain) the election alone doesn’t slow the overall volume of sales. Purchasing is primarily influenced by personal circumstances and broader economic conditions as opposed to the political calendar.

If you want to have a chat about the current market or your property plans get in contact with us today.