Newsletter

Q1 Wrap - 2023

2023 has started off very positively in the property market with many having come back from holidays refreshed and with a new mindset.

When speaking to industry colleagues there is a common theme everyone is busy, I was able to help two clients purchase in February both properties were strongly contested, stylists are booked up to 6 weeks in advance, conveyancers are preparing both sale & purchase contracts and mortgage brokers are getting a high volume of requests for pre-approvals.

The biggest eye-opener for me initially is just the number of people attending open homes whether it's your entry-level homes right up to the prestige sector, how long will this continue?

This shift in mindset I feel is down to a few leading factors, there is a shortage of available properties, Chinese universities have decided to no longer recognise foreign universities online-only degrees bringing more students to Sydney, over 200,000 ex-pats are expected to return in the next 12 months and the majority of buyers becoming more comfortable with the interest rate environment.

What we have seen so far is properties are selling on average within the 5% range of the price guide. There are, of course, outlier sales that exceed this range but the resilience in pricing is down to a lack of available properties so far. The RBA has signalled that the cash rate will be increasing each month until May. Can we believe the RBA’s messaging though? Accuracy doesn’t seem to be their forte.

The main indicator to keep an eye on is stock levels they are tracking lower when compared to previous years. If the volume of listings stays low then house prices will remain resilient as demand outweighs supply. This will also highlight one of the benefits of using a buyers agent, access to off/pre-market properties since the available properties are limited.

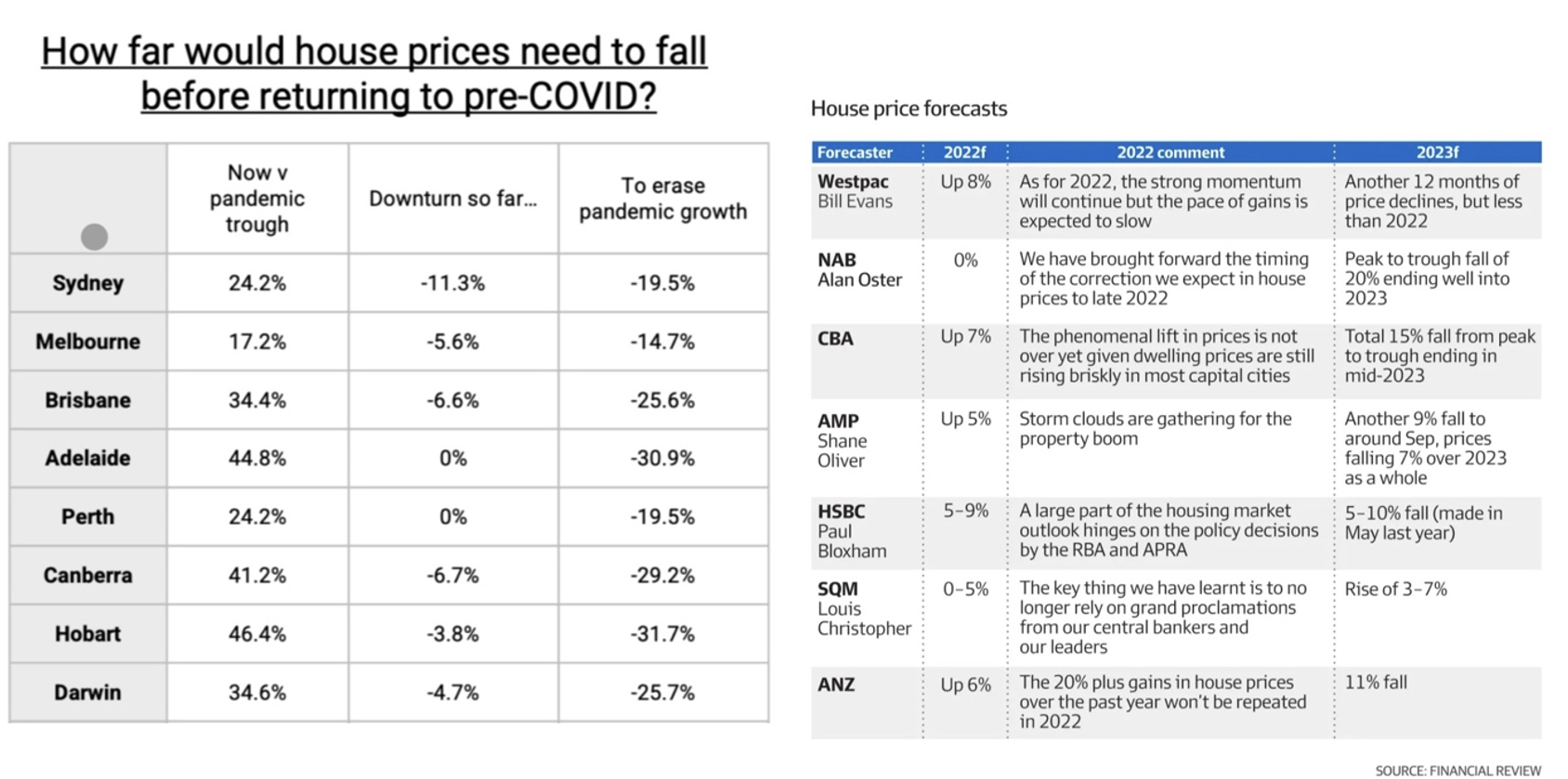

Overall, the property market would need to decline a further 19.5% to erase the gains seen during the pandemic (as seen in the above graphic). This is a great demonstration that if you are considering your options you will be buying at a significant discount to this time last year.

I have included a table of economists' predictions from 2022 which shows that not one of them was correct in their forecasts of the property market. It’s always a good reminder to treat the commentary that you may read with a grain of salt.

Despite the numerous challenges ahead, we see plenty of opportunities in the market for property buyers who are willing to be flexible with their briefs. The key to success isn’t about timing the market but finding the right property for your long-term goals.

If you want to have a chat about the current market or your property plans get in contact with our experienced buyers agents today.

We want to hear more about how we can help you achieve your goals. Send us an email or call us and let's talk about your property needs.

0434 559 452

info@granthambuyersagents.com.au

Book for a confidential discussion

We will get back to you as soon as possible.

Please try again later.

All Rights Reserved | Grantham Buyers Agents