Newsletter

Spring Market Insights

As we enter Spring, more homebuyers are considering their buying/selling options and it’s traditionally the busiest time of the year for the property market. This year began with much uncertainty around the economy and what effect rising inflation and interest rates would have on the property market. In large part what occurred is many lowered their discretionary spending and bunkered down or put their property plans on hold.

So far in 2023, property prices have increased 8.8% and stock levels are 15% lower than this time last year which is a sign of the strength of the Sydney property market.

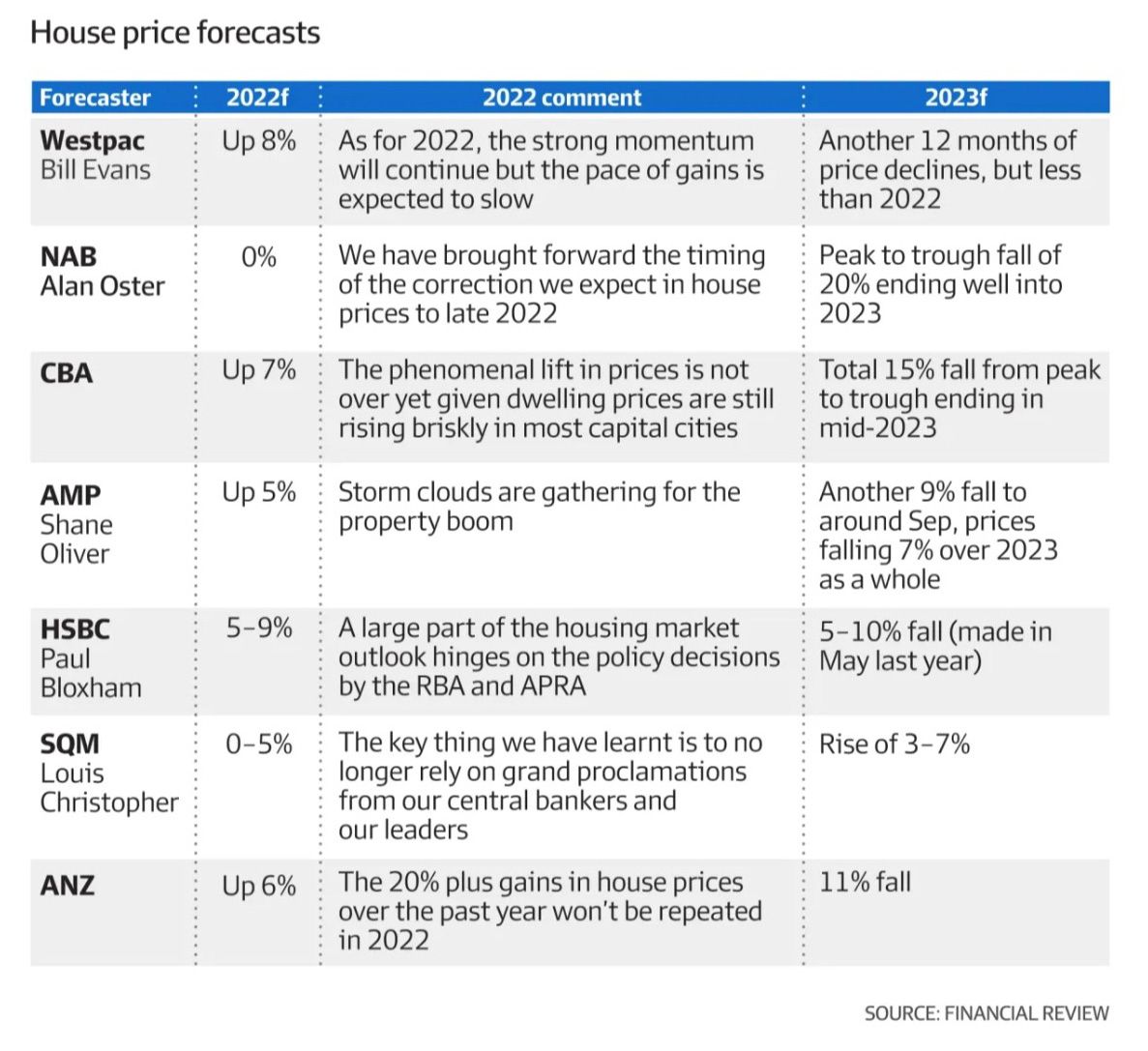

For those who are following economists' predictions, I have included a table above which shows that not one of the economists was correct in their forecasts of the property market. It’s always a good reminder to treat the commentary that you may read with a grain of salt.

The main indicator to keep an eye on is unemployment levels if they are tracking higher towards 4.5% that will put pressure on mortgage repayments and may cause an increase in stock levels.

For the remainder of the year, I foresee stock levels increasing slightly but this being absorbed by homebuyers. We will also see build costs start to taper off as supply chain constraints loosen and more property developments get the green light with Labor’s goal of increasing density in 2024.

If you want to have a chat with a top-rated buyers agent about market trends or you need help finding the right property, get in contact with us today.

We want to hear more about how we can help you achieve your goals. Send us an email or call us and let's talk about your property needs.

0434 559 452

info@granthambuyersagents.com.au

Book for a confidential discussion

We will get back to you as soon as possible.

Please try again later.

All Rights Reserved | Grantham Buyers Agents